Banco de Bogotá's 'Cero Rollo' Credit Card

The campaign aimed to boost Banco de Bogotá credit card acquisition, emphasizing zero management fees with the 'Cero Rollo' card. It focused on driving volume through targeted communications about balance transfers and card benefits.

1,5MM

Impressions

700K

Unique users reached

0,07 USD

CPC

15X

Credit cards aquisition December VS February

Banco de Bogotá, one of Colombia’s leading financial institutions, ranks as the second-largest in customer base and stands out for its strong commitment to digital transformation.

The bank has successfully integrated innovative digital solutions to enhance customer experience, streamlining financial processes and enabling seamless access to its products.

A significant portion of its portfolio is designed for digital acquisition, reinforcing its position as a pioneer in user-centric banking solutions.

By leveraging technology and strategic customer engagement initiatives, Banco de Bogotá continues to drive financial inclusion and operational excellence.

Campaign objective

The campaign's main objective was to drive credit card acquisition by implementing various communications highlighting balance transfers, the benefits of the 'Economía' card, and the 'Cero Rollo' credit card. The strategy focused on increasing card volume with the 'Cero Rollo' creative, given that this product offered zero management fees.

The solution

The strategy was developed based on market research, which highlighted the importance of aligning product offerings with customer needs and seasonal trends. Insights gathered from December’s performance indicated the need for a refined audience segmentation approach to maximize engagement and user benefits. This led to strategic adjustments aimed at enhancing the relevance and appeal of the offering.

By leveraging these insights, the bank optimized its communication and targeting strategies, ensuring a more effective connection with its audience. As a result, February saw a notable shift in customer response, driven by the seasonal impact on consumer behavior. The combination of data-driven refinements and an adaptive approach allowed the bank to enhance the effectiveness of its campaigns, ensuring greater reach and engagement within its target segments.

Products used:

Keys to Success

01

Carousel Ads

The brand aims to highlight all the benefits available to users when they acquire a Banco de Bogotá 'Cero Rollo' credit card.

02

Image Ads

The brand aims to highlight all the benefits available to users when they acquire a Banco de Bogotá 'Cero Rollo' credit card.

The Results?

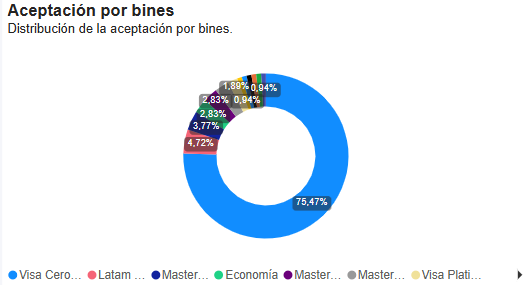

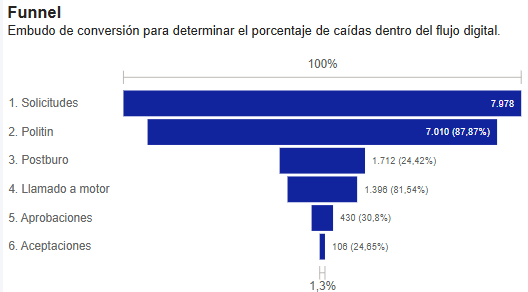

The February campaign showed significant growth in credit card conversions and total disbursements. However, customer acquisition cost (CAC) efficiency declined compared to both December and other platforms. The average transaction amount decreased due to the nature of the campaign.

Credit Card Conversions:

- 106 conversions in February vs. 6 in December.

- 1,667% growth.

- No campaign was active in January.

CAC Efficiency:

- February vs. December: - 4,785%.

- February vs. Other Platforms: -4 73%.

- No campaign was active in January.

Total Disbursement:

258,000,000 COP in February.

- 687% increase vs. December.